In the high-stakes world of cryptocurrency, market sentiment often swings wildly, driven by speculation and the whims of influential voices.

Unlike traditional financial markets, crypto values can skyrocket or plummet based on the collective mood of traders, making it essential to stay attuned to these emotional undercurrents.

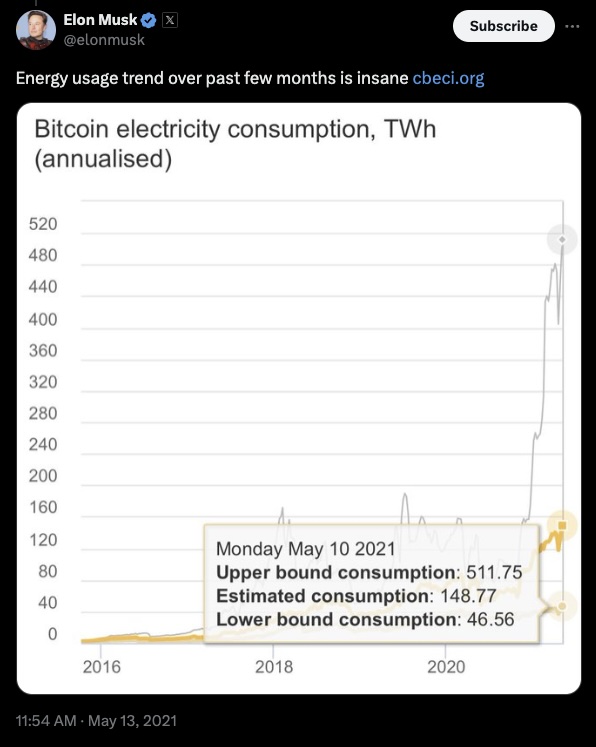

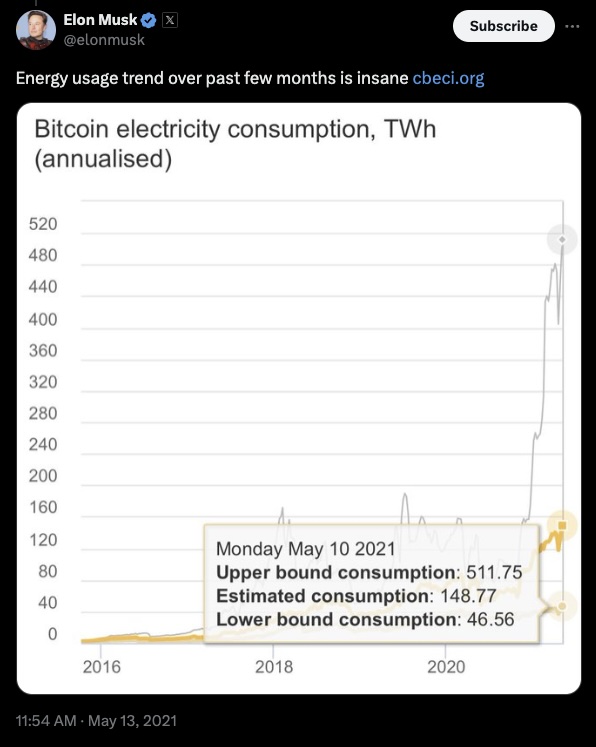

Consider the sway of figures like Elon Musk and Michael Saylor – their tweets and public statements can send ripples through the market, causing dramatic shifts in value almost instantaneously.

For instance, Musk’s tweet about Bitcoin’s environmental impact led to a swift sell-off, underscoring how susceptible crypto prices are to influential opinions.

These events highlight the importance of understanding market sentiment to navigate the crypto landscape effectively.

Given this volatile environment, tools that measure market sentiment are invaluable.

Enter the Fear and Greed Index – a barometer that captures the emotional state of the market.

By interpreting this index, traders can gain insights into the underlying mood driving price movements and feel the pulse of the market for more informed decisions.

The Fear and Greed Index compiles various indicators such as market volatility, trading volume, social media sentiment, surveys, Bitcoin dominance and Google Trends data.

It scores sentiment on a scale from zero (extreme fear) to 100 (extreme greed).

This scale provides a snapshot of market emotions, helping traders identify potential buying or selling opportunities.

When fear and greed dominate

When the market is gripped by fear, indicated by a low score, investors often sell off assets, fearing further losses.

This can lead to undervaluation, presenting potential buying opportunities for traders who recognize the overreaction.

Conversely, when the market is driven by greed, reflected in a high score, investors may become overly optimistic, driving prices up to unsustainable levels.

This often signals a good time to take profits or prepare for a potential correction.

Experienced traders use the Fear and Greed Index as a contrarian indicator. Extreme fear might suggest it’s time to buy, while extreme greed could indicate it’s time to sell.

By aligning trading strategies with these emotional extremes, investors can better navigate the unpredictable waters of cryptocurrency trading.

Current market sentiment

Today, the Fear and Greed Index stands at 70, indicating a strong tilt towards greed. Historically, such high levels of greed have preceded market corrections.

For seasoned traders, this suggests caution. It might be wise to secure profits and reevaluate risk exposure while remaining vigilant for signs of a market shift.

The Fear and Greed Index offers a powerful lens to view market emotions, enabling traders to anticipate and react to shifts more strategically.

By blending sentiment analysis with traditional market indicators, investors can gain a more holistic view of the market, enhancing their ability to make well-informed decisions in the fast-paced world of cryptocurrency trading.

Understanding the interplay of fear and greed not only aids in navigating the present market landscape but also provides a strategic edge, helping traders stay one step ahead in the volatile journey of cryptocurrency investments.

Esin Syonmez is a content writer at Morpher, where she contributes to the company’s mission of financial inclusion and democratizing trading worldwide.

Check Latest Headlines on HodlX

Check out the Latest Industry Announcements

Featured Image: Shutterstock/4K_HEAVEN/Plasteed

Source:

https%3A%2F%2Fcryptonews.com.au%2Fnews%2Fthe-pulse-of-the-market-how-fear-and-greed-shape-cryptocurrency-trading-120896%2F