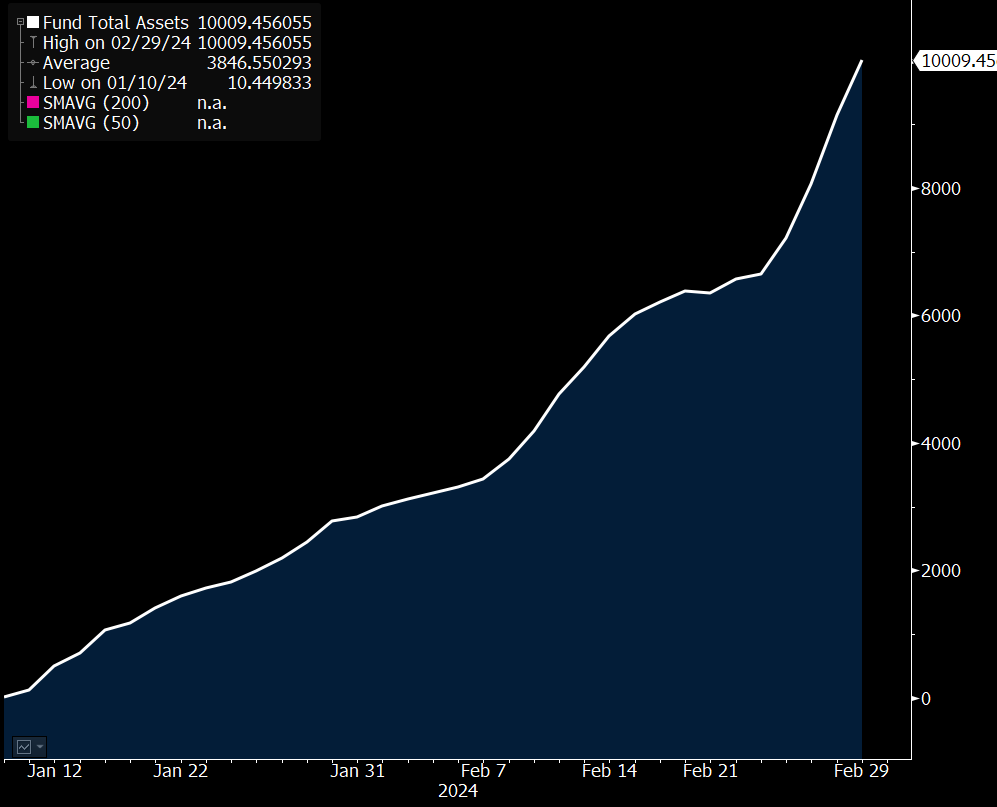

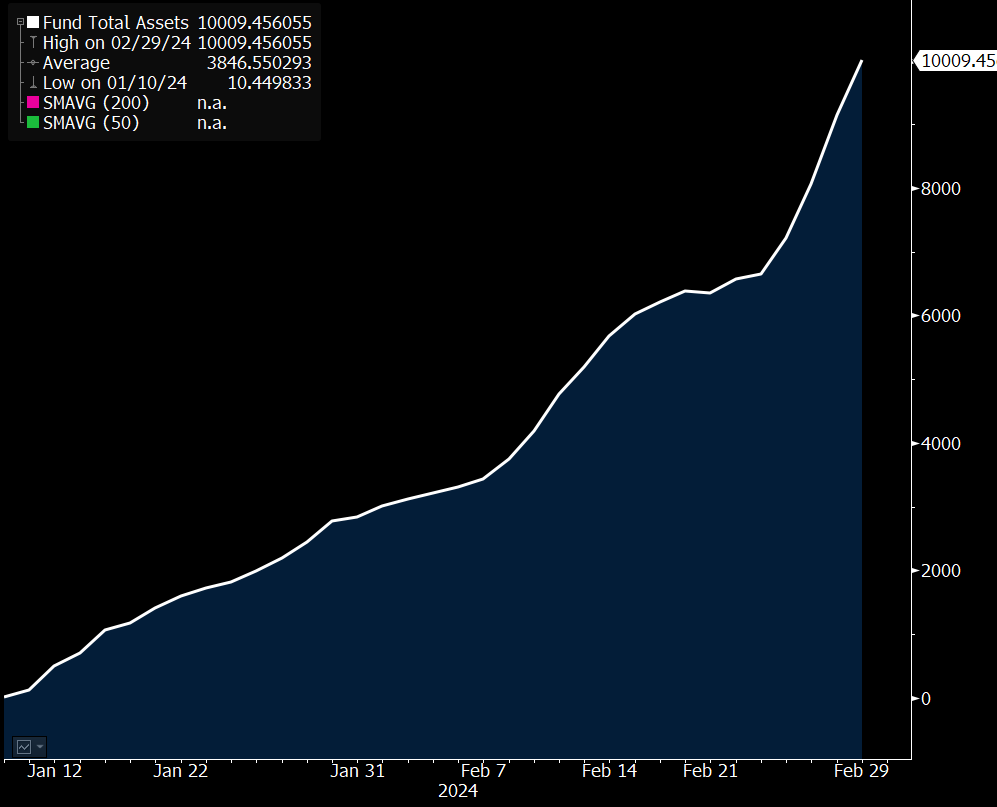

BlackRock’s new spot Bitcoin (BTC) exchange-traded fund (ETF) has already crossed $10 billion in assets under management (AUM), according to Eric Balchunas, a senior ETF analyst at Bloomberg Intelligence.

Balchunas notes the asset management giant’s iShares Bitcoin Trust (IBIT) became one of only 52 ETFs out of 3,400 to cross that $10 billion mark.

The Bloomberg analyst says crossing the first $10 billion mark is tough for ETFs because so much of the initial AUM has to come from flows, but adding $10 billion after an ETF has already surpassed that first mark is easier because market appreciation becomes a bigger variable.

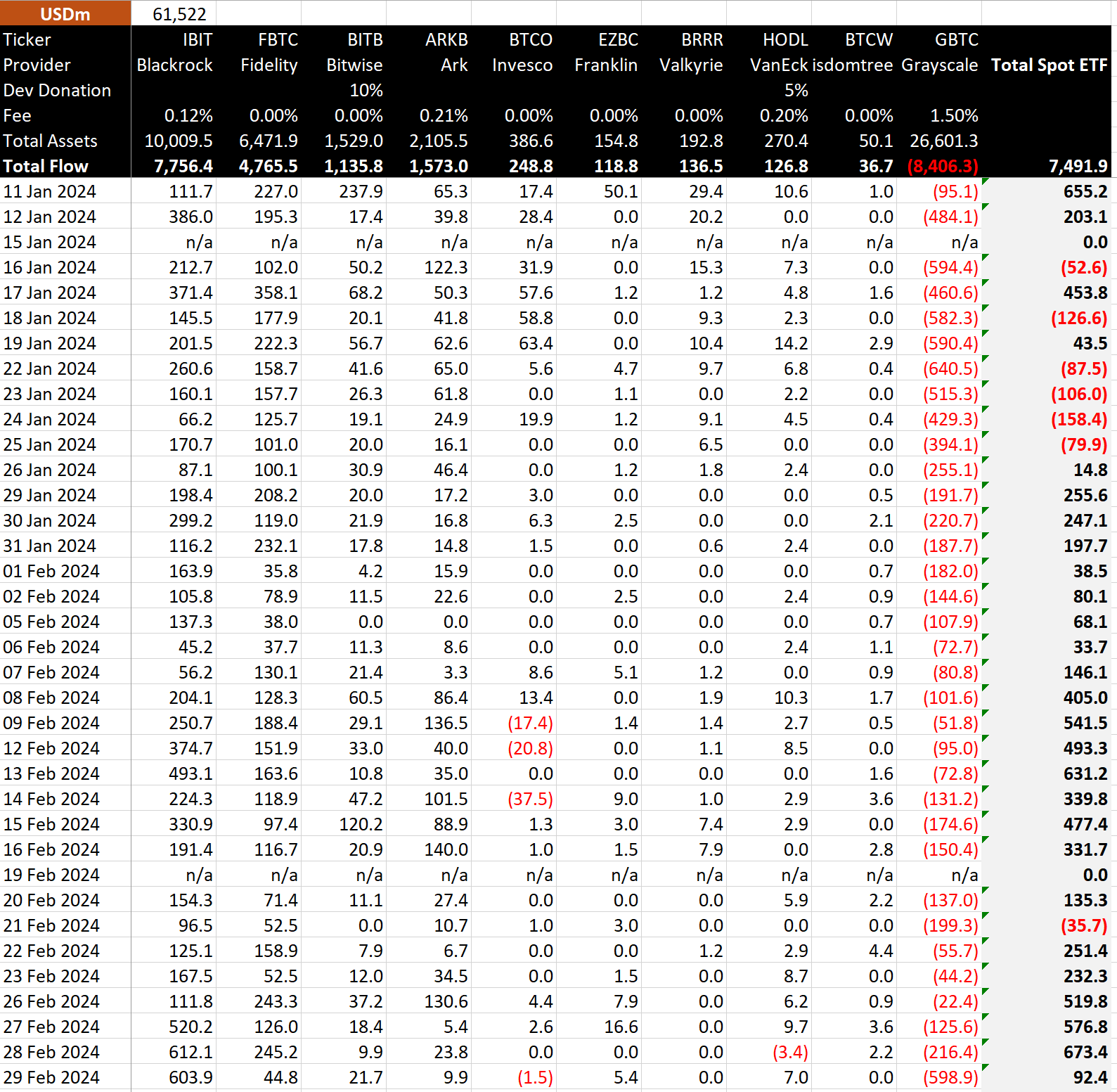

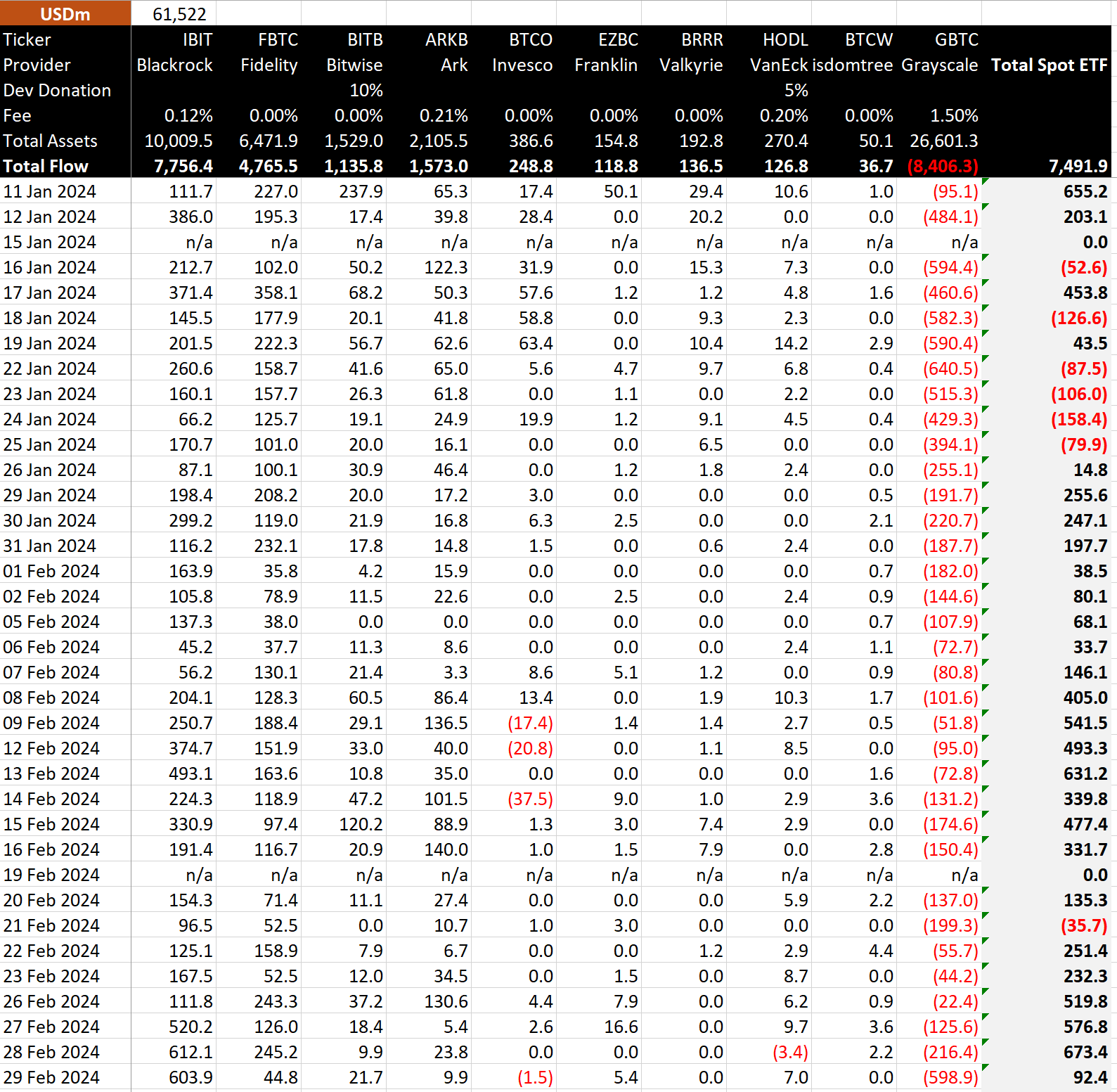

The 10 newly approved spot Bitcoin ETFs witnessed $92 million of positive flows on Thursday, according to BitMEX Research. IBIT itself saw nearly $604 million worth of positive flows alone, though that was largely counteracted by Grayscale’s GBTC, which witnessed nearly $599 million in negative flows.

Of the 10 new ETFs, Grayscale’s is the only one that isn’t an entirely new product: After the U.S. Securities and Exchange Commission (SEC) issued a flurry of BTC ETF approvals in January, the crypto-focused asset management giant converted its existing flagship product, the Grayscale Bitcoin Trust (GBTC), into an exchange-traded fund listed on the exchange NYSE Arca.

Bitcoin is trading at $62,470 at time of writing.

Generated Image: Midjourney

Source:

https%3A%2F%2Fcryptonews.com.au%2Fnews%2Fblackrocks-new-spot-bitcoin-etf-crosses-10000000000-in-assets-under-management-bloomberg-analyst-118230%2F